Today we have the opportunity to talk with you about the new BittWare CVP-13 FPGA miner. This is the most powerful FPGA miner available as December 2018. It is roughly ~50% more powerful both by LUTs and by power than the BCU1525. After weeks of testing we found that it is also very efficient and is able to support a powerful 400 Amp draw off the FPGA chip at 0.76v! We will be covering it’s tested hashrate, power and recommended requirements. We will also test it against some GPU’s just for fun to see how it is going to kick their asses!

If you would like a quick start guide on how to get started, check out our FPGA Mining Resources page.

On to the review! The FPGA is a standard 3/4 form factor that is similar to size of that of a 1080Ti or the VCU/BCU1525. It has two power connectors on it, which allows it to be run independent of the PCIe bus. This unit is water cooled and will require a water cooling system. This will add to the cost and complexity, but it is well worth it as you can hash harder, faster and increase the longevity of your card. It is available for ~$6,000 without needing to preorder. Let’s dive into the specs of this card.

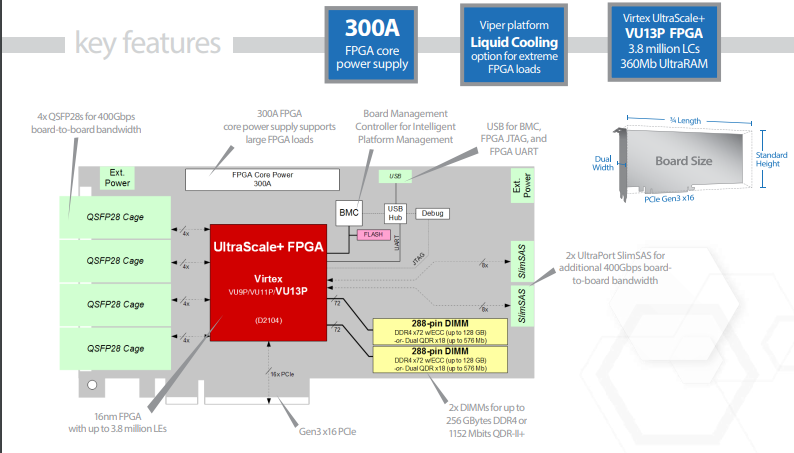

Specifications of the BittWare CVP-13 Ultrascale+

First off the CVP-13 has a Xilinx Virtex XCVU13P FPGA with ~3.8k LC elements. The CVP has some quick memory on it, it has an option for 1152 Mbits of QDR-II+, and up to 800Gbps board-to-board bandwidth. It also carries 360Mb of UltraRAM! It has a maximum storage of 256 GB of DDR4 RAM (optional) with a clock speed of 800 Mhz but realistically will run around 650 Mhz max at the desired voltage of 0.82V.

You will likely just use the onboard Block RAM or embedded memory vs the DDR4 as it is faster and will alleviate the amount of “wires” (virtual while creating a bitstream) and resources needed to the build. This also makes it significantly faster.

The board has a great water cooling block on it that allows us to overclock this and get into the higher end of the FPGA’s clock, which allows more pipelines to provide answers quicker. The board also has a two PCIe power plugs which allow it to mine without being hooked up to risers or the PCI! All you need is power and USB!

A really special feature of the CVP-13 is their Board Management Controller (BMC) that “provides full system

monitoring and control, including core voltage adjustment, automatic shutdown to avoid board damage, and recovery from shut-down.” This is a very useful feature as other cards you may have to use the allmine shell or hack together a DC1613A as per the zetheron guide. The standard CVP-13 does come loaded with the Allmine shell on each board and will communicate with the BMC directly to make your life even easier. This saves you $60-120 but is also integrated so it is easier to use, supported and allows you to pull the data over JTAG with possibilities for a Rest-API. This is helpful so that you can integrate a web based monitoring software such as FreeLearner’s Rigmanager.

It took a little bit to get some speed under the CVP-13, but I am happy to announce that there is an RB1 release from whitefire990 available!

It took a little bit to get some speed under the CVP-13, but I am happy to announce that there is an RB1 release from whitefire990 available!

There are 3 more bitstreams being developed that should be ready early January 2019.

Hardware Setup

Our setup is an older machine that I had sitting around, so honestly this is not ideal and likely IS SLOWING down the possible hashrate. The computer consists of the following components:

| Test System | |

| Hardware: | AMD Athalon II X2 250 2.5Ghz MSI MS-7641 (760GM-P23 (FX) motherboard HP 1200W PS 8 GB Corsair DDR3 1333 1TB HP Blue 7200 RPM JJT (logo looks like WT) 450W power supply Ubuntu 16.04 (with all updates) |

| Case: | ATX Case with 4x bays |

This card is a lot more powerful than our little KU115, so a standard ATX power supply won’t work, while running these bigger cards, you will get strange errors, disconnections, loss of volatile memory programming (bitstreams will disappear). To remedy this you will need to upgrade to a larger power supply. We recommend at least a 1200 watt PS for two cards minimum. Luckily we had an new HP 1200 watt PS sitting around from some old ASICs we had to power. One issue is that the new power supply only has 6-pin connectors coming off of the power supply to our FPGA that has 8-pin. So we purchased some adapters which worked but could not power up the power supply as it is powered off our ATX power plug. Luckily we found Add2PS that allows you to take a Molex connector to the Add2PS then allow you to plug in the ATX power adapter into it, allowing you to run just the larger power supply for the FPGAs and the ATX supply can be used isolate the Motherboard, Hard drive and other components that aren’t as sensitive to the higher quality power supply.

You will also need a high quality water cooling system, in a pinch you can use a 5 gallon bucket and a cold room and this will work pretty well, but as the card hashes it will heat your bucket up to around 100F in a day, so long term you will want to use a radiator/heat exchanger that is a nickel plated copper system. I suggest getting at least a 240mm per card or 360mm for two. You will want a pump that can run at least 1-2 GPM (Gallons Per Minute) per card and you’ll want to add about 2% more flow for piping over 10feet or with 90 degree fittings. The CVP-13 uses Koolance fittings, so you’ll want to get those too. They are pretty nice fittings that allow nice quick connections, albeit a bit spendy per fitting at $15 each.

Mining Results

The bitstream we have to test with currently is from zetheron, which is the RB1 bitstream. We got this all the way up to 1.8Gh/s, but wasn’t able to sustain it for too long unless we increased the voltage to .82, but the power difference wasn’t worth it as the profitability went down on RB1 recently. This card runs cool! At around 1 GPM per card we were able to keep it at around 46C consistently. After we took care of the power supply issues it ran really consistent also, key in a miner. This comes out to around $1.10/day, which doesn’t sound awesome, but then you factor the amount of coins this is producing and it is 14,167 coins/day using about 400W. This bitstream will be updated this week from Whitefire to double this cards output, while others are being made that will be significantly more profitable, such as Nexus and RB3, which should be in the $7-15/day according to Whitefire.

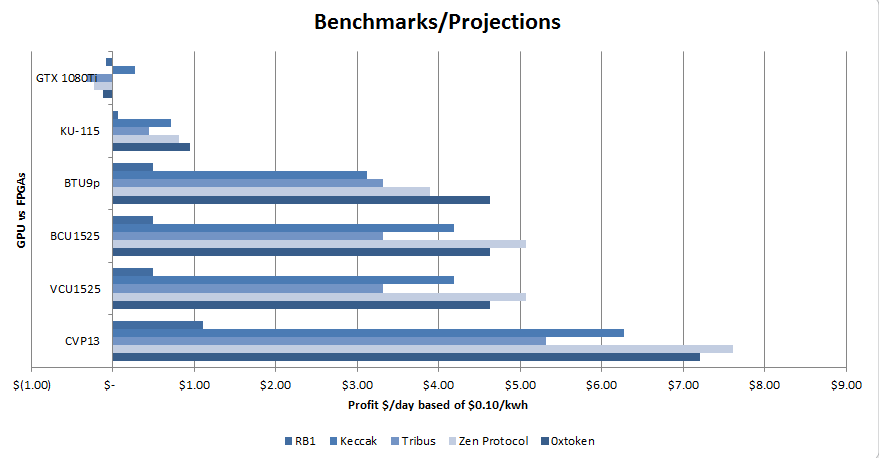

The chart above shows the potential power of the CVP-13 when bitstreams get developed for it in next few weeks, it has the highest earning potential, but currently RB1 is the only available one.

To see where this data came from, we bench tested and grabbed equivalent profitability and plugged them into the chart to compare. There was a lot of data, so the how it is sorted is by algorithm and by a GPU’s best profitability.

As you can see cryptomining is taking a beating the past month. Many farms have gone out of business due to the profitability of the sacred 1080Ti making $0.27/day profit and 6.3 CREA coins/day at 250W. FPGA’s for the same algorithm are 11 times more efficient Megahash/watt to the 1080Ti and 23 times more efficient for the CVP-13! Said another way, for ~$6,000 you are buying 23 1080Ti’s (@$260.87 each!). This chart also shows that EVERYTHING profitable is FPGA and will continue to be so. So what are you waiting for?

Market Analysis and Break Even Point

So what is the Break Even Point (BEP) of the card? As of today it is around 1.1 – 2.3 years at current difficulty and price with the new algorithms coming out. We have many GPU’s that have never paid itself off yet and has the BEP progressively moving out. In the past we have seen the difficulty continue to go up steadily, especially as profitability is doing well. This said, this change in the market is unknown and could also be a huge boon to FPGAs. I will give you the optimistic and pessimistic side of the market and let you see where you fit. I have a small number of FPGA miners which I use predominantly for testings, so I can be a bit objective.

Pessimistic – This card will never BEP, and you’ll have a card you can’t do anything with it. The reason is that at current difficulty and available algorithms it is 6,000 days to pay the card off, if nothing gets made, then your stuck with this payoff. On top of this, the difficulty will rise as history shows and prices will continue to fall, the BEP will be even worse. The millions of coins that you make will be worthless as everything is based off of the value of Bitcoin. If bitcoin fails, so will the market, which it will because it lost 82% ($14,373.87) of it’s value since January.

The exchanges will close due to lack of activity and those fees they survive on. So even if you wanted to exchange the coin to sell them you can’t.

The governments will shutdown bitcoin on a political and environmental front too. Cryptocurrency has shown to be a vehicle of corruption to hide money from embezzlers and unsavory people.

Cryptocurrency uses 44.23 Terrawatts/hour of energy annually, that is more energy than the entire nation of New Zealand. Every block transaction could be used to power 16.4 homes and emitting enough CO2 equivalent to 4,710,870 cars. (Digiconomist) These two reasons alone will give enough political pressure to make cryptocurrency mining illegal.

Optimistic – While it is true that the market is making GPU/ASIC mining unprofitable, the most profitable card is making $0.27/day (1080Ti) while the most profitable ASIC is making $-1.21/day. This means that small to massive farms are losing massive amounts of money daily. People who are hosting are pulling out as the BEP isn’t panning out. Wait you said this was the optimistic side, why is this good?

Well those estimates from Digiconomist show that there is a 60% decrease in power consumption in about 3 weeks! This means that with the current trend we will see the difficulty on a similar trajectory, we are already seeing a 25% decrease (it lags a little) in bitcoin difficulty. This means that FPGA’s will have a huge increase in profitability as GPUs and ASICs fail in the market. A change in a 60% decrease in difficulty (which seems likely) will happen in 2-3 weeks as it is following the consumption path. This changes the CVP-13 profitability from $15/day to $44.36/day based off the newest algorithm being released. While RB1 algorithm could make 1,028,252/month and $5/day per card! If you look at Coinbase Pro you see there is a huge sell window at $3000 which will decrease the coin value temporarily, which will exasperate the disparity from FPGA and GPU mining, this will crush the GPU miners profitability entirely, causing the last farms to go out of business, even Bitmain. This will drop the difficulty to early 2017 difficulty allowing those who held on to make amazing profits. Those of us in FPGA’s will see an additional 65% decrease in difficulty jumping those prices to $63.37/day by May 15th 2019. How did I come up with this information?

I used the exponential growth formula that calculates a value a integer based off a steady change in growth.

Where; x= is the initial value, t= growth rate in decimal form, and t= is the time between duration the change in growth. In the example to the right we have an initial value of 50, a growth rate of 4% and a time of 90 days and it returns a value of 1706 in 90 days at a growth rate of 4%.

So I took the initial difficulty value of 5,646,403,851,534, a growth rate of -10.91% (source), 157 days of change (I arbitrarily chose May 15th 2019) returning a difficulty of 74,975. I did the same thing for the growth rate over the past 365 days, with a starting price of $16,408.20 to today at $3,281.29. This came out to a -0.44% growth rate over the past year. If we continue to project this out. We see the new bitcoin price at $1,642 on May 15th 2019.

So I took the initial difficulty value of 5,646,403,851,534, a growth rate of -10.91% (source), 157 days of change (I arbitrarily chose May 15th 2019) returning a difficulty of 74,975. I did the same thing for the growth rate over the past 365 days, with a starting price of $16,408.20 to today at $3,281.29. This came out to a -0.44% growth rate over the past year. If we continue to project this out. We see the new bitcoin price at $1,642 on May 15th 2019.

With the rise in profitability we may see others hop back on with the decrease in difficulty, which will then bolster the volume of the trades, which will increase the price since the demand will be high and the supply will be low. There are several governments including the entire city of Calgary that accepts cryptocurrency now and the local availability of BTC ATMs in the mall. We will see a rise in the usage of cryptocurrency, Bitcoin will rise, and bring everyone with it. Now that Bitcoin has raised the interest for the world overall, there will be a “pulse” on the market waiting to jump in again. On top of this, banks have shown to the unsavory people we want to keep our money from, in 2018 we had over 100 charges against banks from money laundering, fake bank accounts, and outright stealing from their customers. This will entice the average consumer to use cryptocurrency more. As for the environmental aspect, this is a huge issue, but to decrease electricity cost miners will switch to renewable energy (possibly even mandated) to make our crytptominers emission free. This would make sense as the top 3 cheapest energy sources are renewable energy.

There is a possibility that we need to get out of BEP $/day thinking in this bear market and think about opportunity. This card makes nearly 15,000 coins per day on this algorithm and can be stockpiled, transferred to other coins and can be used as a HODL technique while costing very little to run in electricity. This card also produces the most coins at current difficulty, which means that while it is mining against other cards it will make more coins per year than the competitor, with difficulty always going up, it may be good to have a leading edge.

Conclusion

The BittWare CVP-13 is an excellent piece of hardware. It is fast, robust, and the largest in it’s class and for the price it is a steal, considering that just one chip is $43k each for a one off. This card has huge potential in the FPGA mining relm, and would offer a significant viability for reseale in standard FPGA industries due to its capacity. Currently it’s only limitation is that it only runs the RB1 algorithm and the bear market in crypto right now, which just a month ago would of yielded you over $25/day and today is $1/day.

With this cards capability, quality of hardware and it’s software package, this is a steal at ~$6,000 if you are holding out for big gains in crypto in the future, but it could also never pay for itself. My goal is to propose a logical path to the data. Your willing to risk will decide what is the best path for you. I hover someplace in the middle, I am gathering coins and HODL for a hope for the price to raise, which I think is pretty reasonable, but who knows!

Please comment below and ask any questions you may have! I hope you found this interesting and packed full of the info you want!

As always I hope this is one step closer to living free each and everyday!

For the past 20 years I have been advocating and teaching about Renewable Energy and Alternative fuels. I worked in IT for 9 years and ran a few IT businesses during that time. I have worked wind turbines and in fuel cell technology and I currently teach college courses full time in Renewable’s and Alternative fuels. I am passionate about technology, building things, family and having fun outdoors. I love sharing and helping to make the world a better place in my own way.